Auto Insurance in and around Athens

Athens's first choice car insurance is right here

Let's hit the road, wisely

Would you like to create a personalized auto quote?

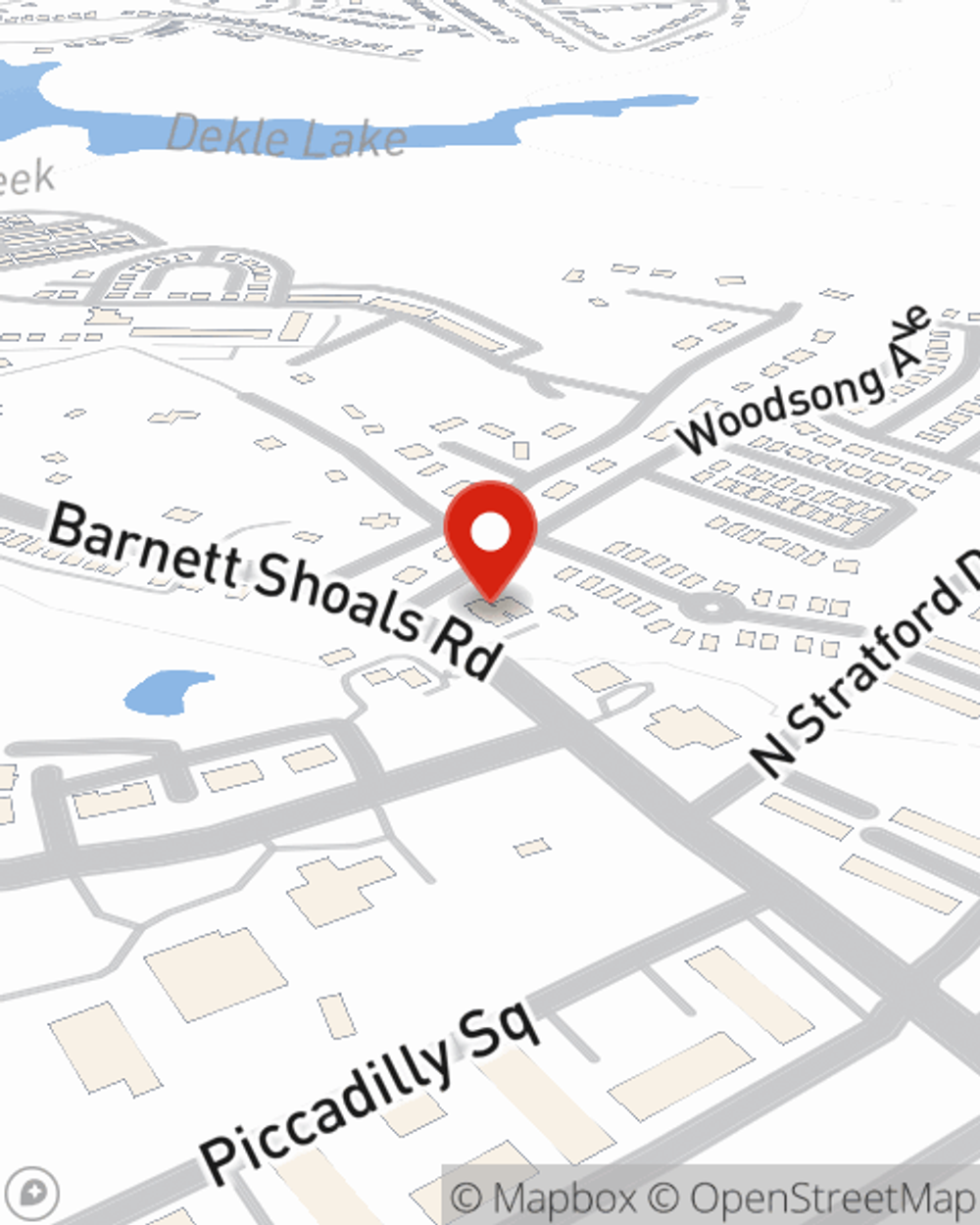

- Athens

- Clarke County

- Oconee County

- Barrow County

- Madison County

- Jackson County

- Walton County

- Gwinnett County

- Cobb County

- Cherokee County

- South Carolina

- DeKalb County

- Fulton County

State Farm Has Coverages For Your Needs

If "vehicle owner" describes you, auto insurance is your next step. And since that vehicle is no doubt a necessary piece of your day-to-day, you'll want to make sure to choose the right amount of dependable coverage, as well as maximize your eligible savings. Don't worry, State Farm can help.

Athens's first choice car insurance is right here

Let's hit the road, wisely

Great Coverage For A Variety Of Vehicles

You need State Farm auto insurance, the largest auto insurer in the United States. When the unexpected finds you, State Farm is there to get you back to your usual routine! Agent Shane Dekle has the competence and dedication you need when unfortunate incidents cross your path.

Don’t let unfortunate events slow you down! Contact State Farm Agent Shane Dekle today and find out how you can benefit from State Farm auto insurance.

Have More Questions About Auto Insurance?

Call Shane at (706) 543-8400 or visit our FAQ page.

Simple Insights®

Tire maintenance, safety and care

Tire maintenance, safety and care

Yes, you do need to learn how to take care of your tires. These seven simple to-dos can take just minutes.

How to merge onto the highway

How to merge onto the highway

For safer merging, you should never assume other motorists will make room for you. Read these tips from State Farm to learn how to merge lanes and help prevent merging accidents.

Shane Dekle

State Farm® Insurance AgentSimple Insights®

Tire maintenance, safety and care

Tire maintenance, safety and care

Yes, you do need to learn how to take care of your tires. These seven simple to-dos can take just minutes.

How to merge onto the highway

How to merge onto the highway

For safer merging, you should never assume other motorists will make room for you. Read these tips from State Farm to learn how to merge lanes and help prevent merging accidents.